Emerging markets series - Topic 1

Best practices for doing research in Emerging Markets

Foreword

BRAZIL

At Windrose, we are celebrating a year since having acquired Parioforma, a leader in value, access and price assessments in non-traditional markets. The acquisition has strengthened Windrose’s expertise in emerging markets, which has been a significant driver of growth in recent years.

To commemorate this past year, we are going to publish a series of articles, written by Amy Morgan (our Head of Emerging Markets) that will delve into Emerging Markets and the more considered approaches that need to be taken. Our first article considers Best Practices for doing research in Emerging Markets.

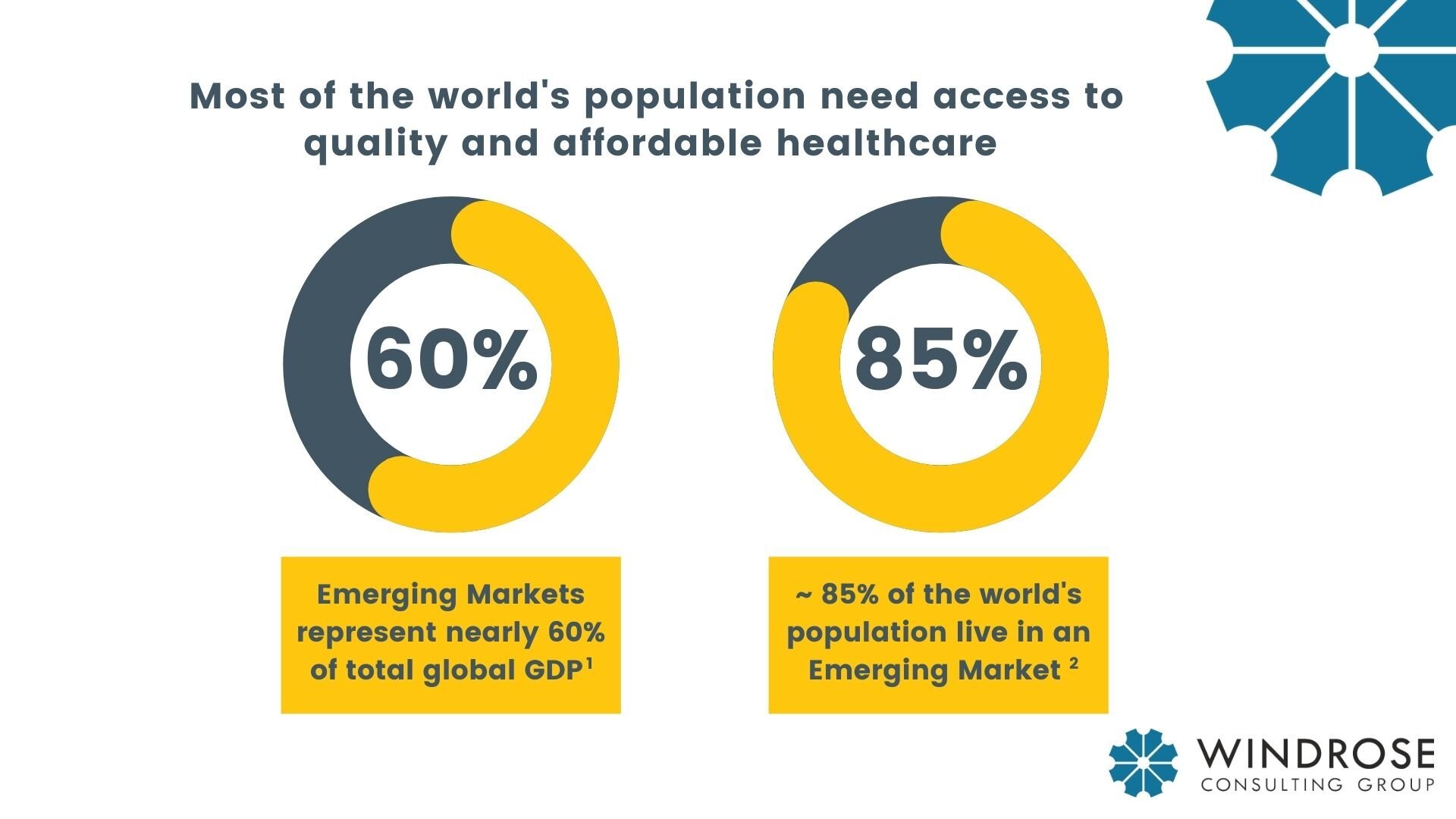

Emerging Market countries today represent nearly 60% of global GDP [1]; and in total, around 85% of the world's population live in an Emerging Market country [2], which translates into a lot of people who need access to quality and affordable healthcare

In spite of the efforts to build national health services with universal coverage, today the health systems of many Emerging Market countries remain highly pluralistic – i.e., patients depend on a range of public and private health care providers, many of which are not controlled by national health authorities. Under these systems there continues to be heavy reliance on out-of-pocket spend and private insurance, placing a high burden on the patient in terms of cost.

Based on Windrose’s extensive experience in managing research projects involving emerging markets, here we present some ‘best practices’ for conducting effective market research in these territories.

Understand the environment

Pharmaceutical products that are commercially successful in developed markets may find market access in Emerging Markets challenging. This is often due to their higher price tags, payer rigidity, limited local clinical pathways, patient access challenges, low disease awareness and poor diagnosis.

In order to ensure that the project objectives are achieved, the project scope must be tailored to each individual market. To achieve this, there needs to be a deep understanding of the local healthcare environment, careful mapping of the products currently available, as well as a good understanding of local cultural and behavioural nuances.

Be mindful of market segmentation

‘Within country’ inequality in these markets needs to be accounted for – often leading to internal market segmentation in terms of both economics and geography.

In terms of economics, the most common approach is to segment across the private and public sectors. However, such a simple division may not always be appropriate since Emerging Markets countries vary widely in the extent to which the population purchases medicines in the private and public sectors. Private customers are not necessarily better off than those who rely on the public sector; and in some countries, rural public health centers are so sparse that the poorer rural population have no choice but to rely on the private sector.

Geographical inequality remains one of the primary barriers to health access in Emerging Markets. Some of the most unequal countries in the world are also the largest and ‘remoteness’ further compounds the fact that many of these markets are resource restrained to begin with.

Combining economic and geographical heterogeneity can lead to vast disparities between the cities and regions. In many of these territories, we are now seeing a rising demographic of wealthy urban patients who can afford better-quality healthcare, and who have an appetite for Western lifestyles and products.

As such, it remains important that new products are considered within both the public and private healthcare settings, and that the wealth inequality across those sectors is accounted for in terms of affordability not only to healthcare payers but also to individuals.

Identify the correct stakeholders

The presence of pluralistic healthcare systems requires engagement with multiple, parallel stakeholders. In addition, the ‘correct stakeholders’ often vary from traditional markets because the patient journey in Emerging Markets is less clear-cut.

The fact that a large percentage of the population in these markets pay for their own healthcare gives rise to ‘patient payers’. Added to this is a growing middle class across all Emerging Markets who are willing to pay a small premium for quality medicines. These patients have the freedom to choose medications they trust and that may add value in other ways. Consequently, physician influence and patient choice can be critically important considerations when conducting research.

Some Emerging Markets also have a blurred distinction between ethical drugs and Over the Counter (OTC) drugs, meaning that prescription-only medications might be purchased without prescriptions. Hence, pharmacists may carry increased weight in the sale of a particular drug and therefore be relevant to include in the research scope.

Employ the appropriate protocol and approach

Stakeholders in Emerging Markets are often not comfortable interacting without direct human contact. Many – notably physicians – have a high social status, and it is deemed disrespectful not to meet face-to-face. This is particularly common in Middle East and North Africa (MENA), Asia-Pacific (APAC) and Latin America (LatAM). However, recent COVID restrictions have seen a relaxation in this expectation, demonstrating how cultural norms can shift rapidly in these regions.

There is no reason why qualitative research and projective techniques should not work as well in Emerging as they do in Developed Markets; however, they should be approached with caution.

Key takeaways to ensure project success are:

Respondents need to clearly understand the objectives of the research techniques so that they are not taken out of context.

More guidance may be required to help respondents think in more abstract ways.

Care must also be taken in the interpretation of research findings to understand the cultural context.

In our experience, conducting research in these regions requires flexibility, especially when the project objectives are complicated. Useful insights follow on from a considered, iterative approach. Windrose recognize that Pricing and Market Access (P&MA) research cannot be just a source of expertise, but that it is essential to guide our clients’ business strategy.

For more information or to discuss any questions you have on Emerging Markets, please contact Amy Morgan Head of Emerging Markets at Windrose Consulting Group.

Sources

Based on PPP-adjusted USD, source IMF.

Speech by Christine Lagarde, Managing Director, IMF at University of Maryland, February 4, 2016.