Pricing and Market Access (P&MA) Challenges in Switzerland

Recent P&MA Policy Changes

TPA Reforms[1]: In 2019, the Swiss Federal Council modified the Therapeutic Products Act (TPA) to facilitate market access, improve drug safety, and increase transparency in Switzerland’s P&MA system. In an effort to improve access and communication between Swissmedic and the FOPH, changes were made to increase the scope of information published by Swissmedic about medicinal products, which included a summary report of their perception of the clinical trial results.

2020 MEA Legislation[2]: In 2020, a Managed Entry Agreement (MEA) legislation was established by Switzerland’s Ministry of the Interior to address ongoing P&MA challenges such as time to reimbursement and the restrictive ability to achieve a premium vs. comparator. The legislation sought to establish confidential market-access schemes, specifically three types of MEAs (price refunds, sales volume limits, and pay-for-performance). This provides manufacturers the opportunity to negotiate confidential net prices.

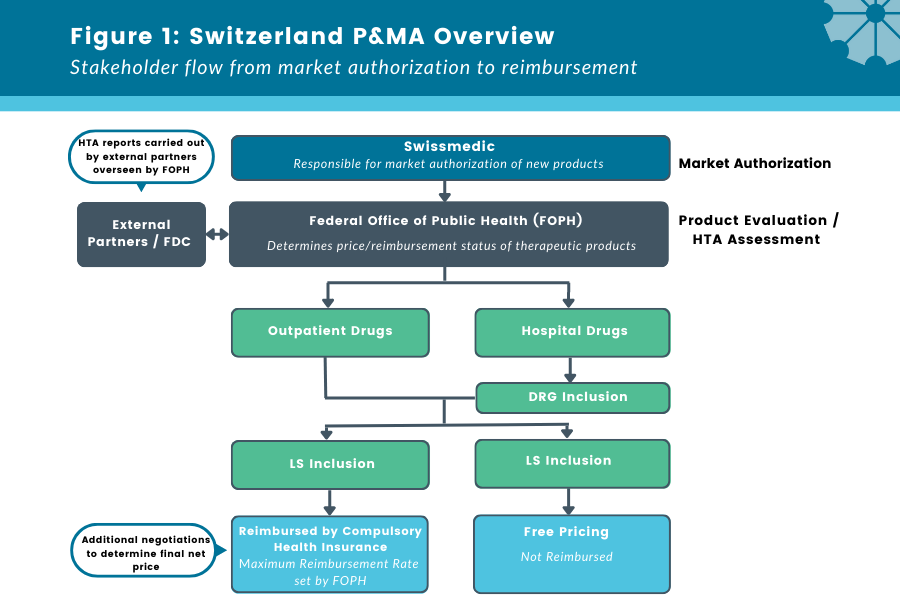

Despite these recent Swiss reforms, the P&MA system still poses challenges for pharmaceutical companies in launching innovative products, including time to reimbursement, restrictive price setting, and DRG variation for hospital drugs. Here, we describe the Swiss P&MA system, potential access challenges, and future implications.

What does the current Switzerland P&MA system look like?

Figure 1: Switzerland P&MA Overview

Stakeholder flow from market authorization to reimbursement

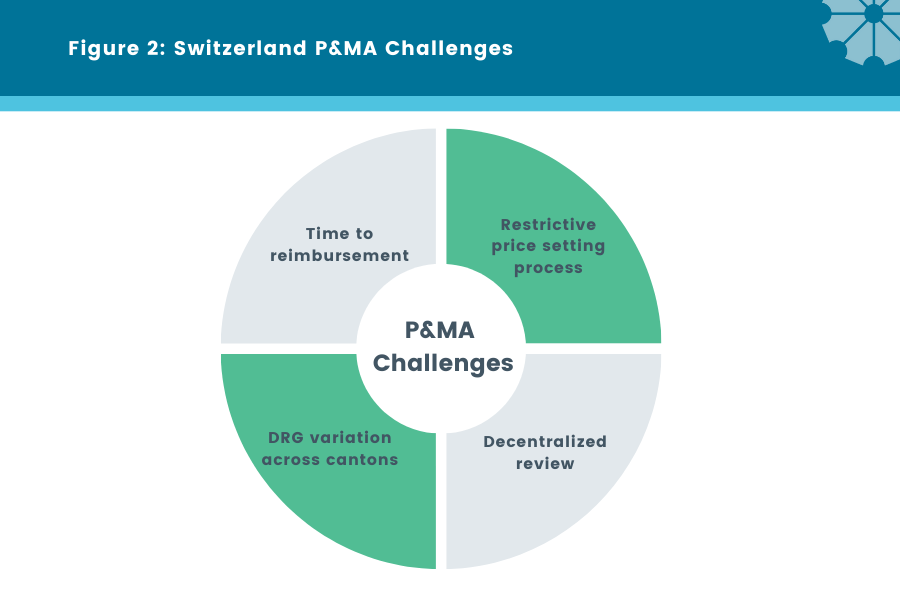

Figure 2: Switzerland P&MA Challenges

P&MA Challenges [3]:

Time to reimbursement

One of the key challenges for manufacturers with the Swiss P&MA process is the time to reimbursement / regional procurement from initial product submission. There are significant delays in product access and availability for patients mainly due to external HTA evaluation overseen by the FOPH as well as a separately conducted price-setting process (which can take up to an additional 150 days to complete). These delays are more problematic for orphan drugs, where patients with fewer available options in areas of high unmet need suffer the greatest consequences with delays in reimbursement and access.

Decentralized Review

HTA results are often inconsistent because of the decentralized HTA assessment process, which is conducted by third-party reviewers and overseen by FOPH. This lack of consistency and transparency makes it difficult for manufacturers to predict the key evidence requirements and ensure that they are met. Also, additional evidence requests are often required, further delaying the time to patient access.

Ability to Achieve a Premium is Restrictive

The current list price setting mechanism in Switzerland limits the ability to achieve a premium vs. comparator, sometimes making Switzerland unattractive for innovative products. Alongside the formal FOPH assessment, internal and external reference pricing is used to determine the maximum reimbursement price. Internal reference pricing is utilized to determine a ceiling price for a product, which can be ‘unfairly’ restrictive as the reference basket can include generics or low cost, off-label therapies. In addition, R&D costs are only accounted for products that demonstrate significant therapeutic progress within the therapeutic comparison framework. Other cost offsets (i.e., transplantation) are typically not considered. Therefore, the price setting process itself can impact pricing potential, particularly for innovative products where only low-cost generics / off-label therapies are available in the treatment landscape.

DRG Variation Across Cantons

DRG-based hospital differs across cantons*, creating inconsistencies in coverage across Switzerland. While each hospital can create its own formulary, this creates fragmented ‘net’ pricing and hospital restrictions. Local negotiations can be time-consuming and may create further delays to access. As a result, there is inconsistent access and uptake of products and/or services across the country. In the future, there may be opportunity for hospitals to group together to realize efficiencies in the local negotiation and procurement process – policies common in Nordic countries. So far, this is only evident at a regional level in the French part of Switzerland through CAIB. CAIB, is a public, non-profit central purchasing organization leads the procurement for the 2 university hospitals and 12 regional hospitals.

Windrose’s Take - Solutions & Implications for the Future:

Based on the 2019 and 2020 legislation changes, manufacturers need to be prepared to support the new pricing models submitted to the FOPH as part of the MEA legislation reforms.

To anticipate the level of evidence required, identify similar analogs and analyze their appropriate evidence through published reports.

Where possible, manufacturers should pursue one of the 3 predefined MEAs best suited to their product that will address the CH payer uncertainties and challenges

Having MEAs in place will help to address the heterogenous uptake of products and service at the hospital level, leading to more equality in patient access and uptake.

Additionally, this provides ability to have confidential price discounts, which allows manufacturers to protecting the net prices from international reference pricing visibility.

Since the level of reimbursement can differ across cantons, manufacturers should also target cantons based on the time to reimbursement and uptake, with early engagement key to estimate the expected list to net discount, access, and uptake in each canton.

Finally, to help secure premiums, manufacturers should identify markets where similar considerations apply, and develop a global strategy based on this archetype.

Abbreviations:

FOPH = Federal Office of Public Health

MEA = Managed Entry Agreement

DRG = Drug Related Group

FDC = Federal Drug Commission

LS = List of Pharmaceutical Specialties

HTA = Health Technology Assessment

*Regional subdivision of country

Article co-authored by Paige Stitzel and Agatha Cimbalova, Windrose Consulting Group.

Sources:

2. https://www.eversana.com/2020/08/25/switzerland-cost-containment/

3. http://www.swisshta.org/index.php/HTA_in_Switzerland.html