Emerging Markets Series - Topic 2

Barriers to effective access to medicines in Emerging Markets

Foreword

At Windrose, we have been celebrating over a year since having acquired Parioforma, a leader in value, access and price assessments in non-traditional markets. The acquisition has strengthened Windrose’s expertise in emerging markets, which has been a significant driver of growth in recent years.

To commemorate this, we are publishing a series of articles, written by Amy Morgan (our Head of International Markets) that delve into Emerging Markets and the more considered approaches that need to be taken. Our second article considers the Barriers to effective access to medicines in Emerging Markets.

As Emerging Market governments look to expand their healthcare provision towards universal coverage, they are also looking for ways to contain costs. Varying rates of Health Technology Assessment (HTA) adoption may mean that while pharmacoeconomic and budget impact considerations are not new concepts, the ability to assess and quantify them for decisions on inclusion, exclusion, price negotiations, and payment models, may be limited. This can sometimes lead to unsophisticated price comparisons and crudely applied budget limits that challenge or prevent patient access to innovative therapies. Value-based agreements and innovative contracts have emerged in developed markets to find a balance between budget management and patient access, but challenges to the implementation of these models in Emerging Markets beyond simple volume-based agreements or discounts, persist.

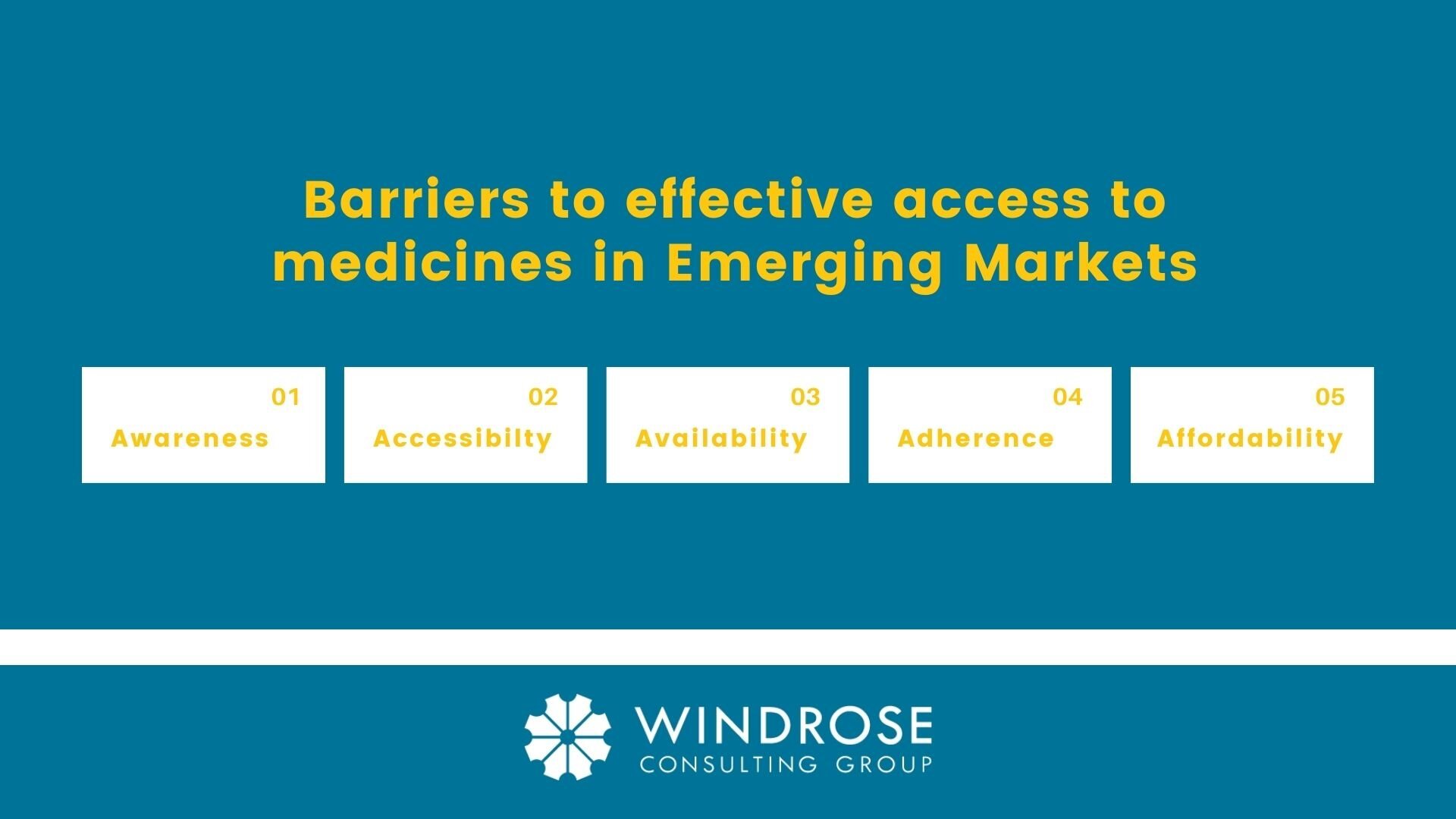

Based on Windrose’s extensive experience in conducting pricing & market access research, we have identified five barriers to effective access to medicines: awareness, accessibility, availability, adherence, and affordability. Not all of these may be adequately met in Emerging Markets and as such, present challenges when pursuing a ‘value-based’ pricing approach.

BARRIERS TO EFFECTIVE ACCESS TO MEDICINES IN EMERGING MARKETS

Awareness:

First is lagging disease awareness and education of both healthcare professionals and patients themselves. For example, many cancer cases in Emerging Markets are diagnosed at later stages of disease due to limited disease awareness and/or access to screening procedures. Once diagnosed, the patients are often beyond the point of treatment. Low awareness of the right treatment protocols or the benefits of new medicines can further exacerbate this issue.

Accessibility:

Second is inadequate accessibility to care due to fragmented healthcare infrastructures challenged by limited resources, restricted government healthcare budgets and complicated geographies. In many developing countries, the demand for adequately skilled healthcare professionals far exceeds the supply. Often there are not enough hospitals, clinics, diagnostic equipment, or trained medical staff to diagnose and treat patients – notably in rural areas which are often completely underserved by healthcare facilities and personnel.

Availability:

Third is the lack of availability of medicines in local pharmacies or hospitals near the patient. Shortages of medicines are frequently reported in all global markets, but a host of factors further challenge availability in emerging economies. Complicated and fragmented supply chains, limited storage and cold chain management, ineffective demand forecasting, and rigid rules on procurement and tenders can all impact availability.

In addition, challenging pricing and reimbursement environments in Emerging Markets mean that many new medicines are either excluded from public reimbursement or are highly restricted. The survival rates of cancer patients can be two times lower in developing markets due to the lack of available quality treatments.[1]

Adherence:

Fourth is adherence. According to the World Health Organization (WHO), adherence to long-term therapy for chronic illnesses averages only 50% in developed countries.[2] In developing countries, the rates are even lower. For patients with chronic conditions, poor management and follow-up coupled with a lack of understanding by patients of their diseases and the complex regimens, present major obstacles in these territories. The consequence is that the patients who maybe lucky enough to receive innovative treatments, are often not meeting the outcomes expected from them.

Affordability:

Fifth is affordability, not just of the new medicine, but of the interventions across the entire care pathway. Escalating healthcare costs due to a growing prevalence of chronic diseases, ageing populations and the impact of the Covid-19 pandemic is placing increasing pressure on government healthcare budgets globally, but this pressure is being felt more acutely in emerging economies. In addition, the fact that a large percentage of the population in these markets pay for their own healthcare means that affordability needs to be considered not only in context with the healthcare system itself, but also in relation to individual patients.

The higher price tag of innovative therapies has hindered access to these medicines for a large percentage of the population in Emerging Markets. Given the barriers to effective access, many patients in these territories do not get to the point in the care pathway where they are eligible for an innovative medicine. For example, many cancer patients remain undiagnosed and for those diagnosed; only a few may get access to the surgery, radiation or chemotherapy that often precedes the use of innovative therapies, and the small numbers with access to these medicines are often not managed optimally. These patients are not receiving the full benefit of high-cost treatments and as such, payers in Emerging Market are failing to recognize or justify the true ‘value’ of these products. This lowers their willingness to pay and when ‘value’ is not recognized, the argument for ‘value-based’ pricing is lost.

When designing research in Emerging Markets there needs to be a more considered and tailored approach in communicating ‘value’ within the context of the market access barriers discussed above. Pricing and budget concerns remain a constant as does payer rigidity. Payers in these markets have difficulty recognizing value; and ‘value-based’ pricing itself as a concept, does not always resonate with them as their ‘go-to’ price build-up has traditionally been focused on channel mark-ups and tariffs.

For more information or to discuss any questions you have on Emerging Markets, please contact Amy Morgan Head of International Markets at Windrose Consulting Group.

Sources:

7Lopez-Gomez M, et al. Cancer in developing countries: the next preventable pandemic. The global problem of cancer. Clinical Reviews in Oncology/Hematology, 2013. Volume 88 (13), pp 117-122

Sabaté E. Adherence to long-term therapies: evidence for action. Switzerland: World Health Organization; 2003.